What’s the real value of AI in investment banking?

AI is transforming investment banking, not replacing jobs. Learn how it boosts productivity, streamlines processes, and empowers bankers.

Key Takeaways

AI enhances human capabilities, freeing investment bankers for strategic work.

AI-powered tools streamline workflows, saving time and resources.

AI uncovers hidden patterns and insights in massive datasets, informing decision-making.

AI transforms due diligence, trading, risk management, and portfolio optimization.

Ethical AI implementation is crucial for trust and the responsible use of technology.

Emerging technologies like NLP and quantum computing will further advance AI in investment banking.

Last year, I started Multimodal, a Generative AI company that helps organizations automate complex, knowledge-based workflows using AI Agents. Check it out here.

Back in my trading days at Bridgewater, I recall countless hours spent poring over spreadsheets, financial statements, news feeds, and market data, trying to pinpoint trends and make informed decisions. Unlimited grunt work ate up my and my team’s time.

In those days, technology simply didn’t have the potential to assist with complex workflows, which means traders and investment bankers could never meaningfully automate their grunt work.

Fast forward to today. With gen AI, it’s not only possible to automate mundane, repetitive tasks for finance teams, but also add more value with applications like fraud detection, AML, due diligence, etc.

In this article, I'll draw from my own experience and the latest industry developments to unveil how AI can augment investment bankers and where its future in IB lies.

Why AI is a natural fit for investment banking

Artificial intelligence can liberate investment bankers from the mundane and empower them to focus on what they do best: strategic thinking, client relationships, and making high-stakes decisions.

So before we begin, I want to stress that AI can augment, assist, and make finance professionals more efficient instead of disrupting or replacing them.

Investment banking, at its core, is a data-driven industry. It thrives on the ability to process and analyze vast amounts of information to make informed decisions. This makes it a fertile ground for artificial intelligence, which is best suited for data-heavy environments and complex problem-solving.

Data, data, data

Investment banking generates, consumes, and depends on a deluge of data.

From financial statements and market trends to economic indicators and geopolitical events, the sheer volume and variety of information can be overwhelming. AI, with its ability to process massive datasets quickly and efficiently, is perfect to tackle this challenge.

Deloitte’s 2023 industry predictions report supports this:

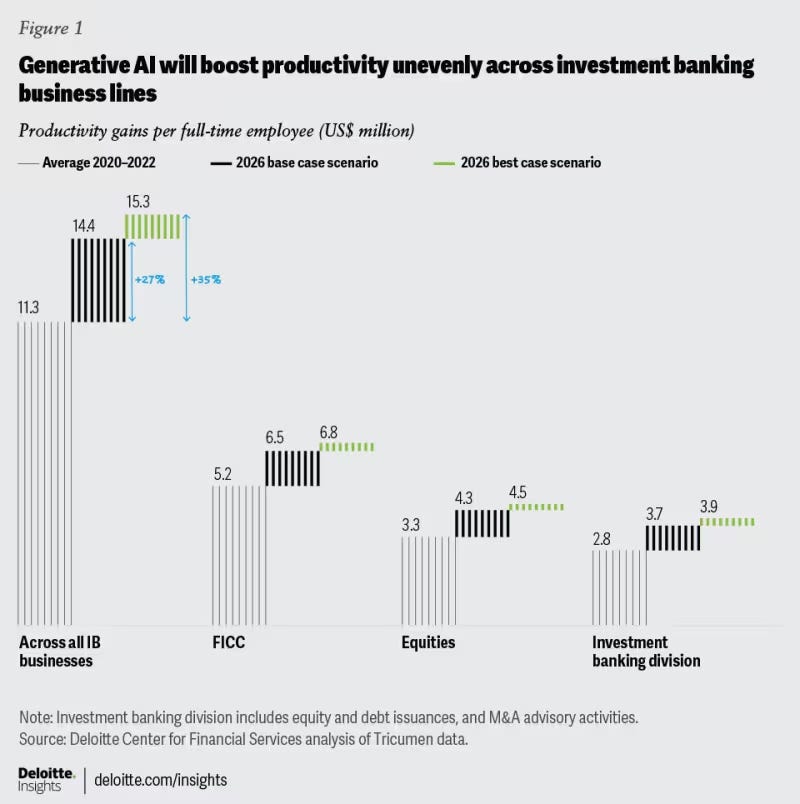

"The potential of the technology to transform investment banking activities seems to be vast, and the applications are far-ranging…Top investment banks can boost their front-office productivity by 27%–35% through the strategic use of AI.”

Pattern recognition

Beyond processing data, AI excels at identifying patterns and relationships that may not be immediately apparent to human analysts. This is particularly valuable in investment banking, where recognizing subtle trends and anomalies can lead to significant gains or risk mitigation.

Machine learning algorithms can analyze historical data to predict market movements, identify promising investment opportunities, or flag potential risks. For example, UBS utilizes machine learning and neural networks to enhance the decision-making of its traders, including fund allocation and real-time data analysis.

Speed and scale

AI's ability to analyze data and execute trades at lightning speed can give firms a competitive edge. High-frequency trading (HFT), which relies on AI-powered algorithms to make split-second decisions, is a prime example of this.

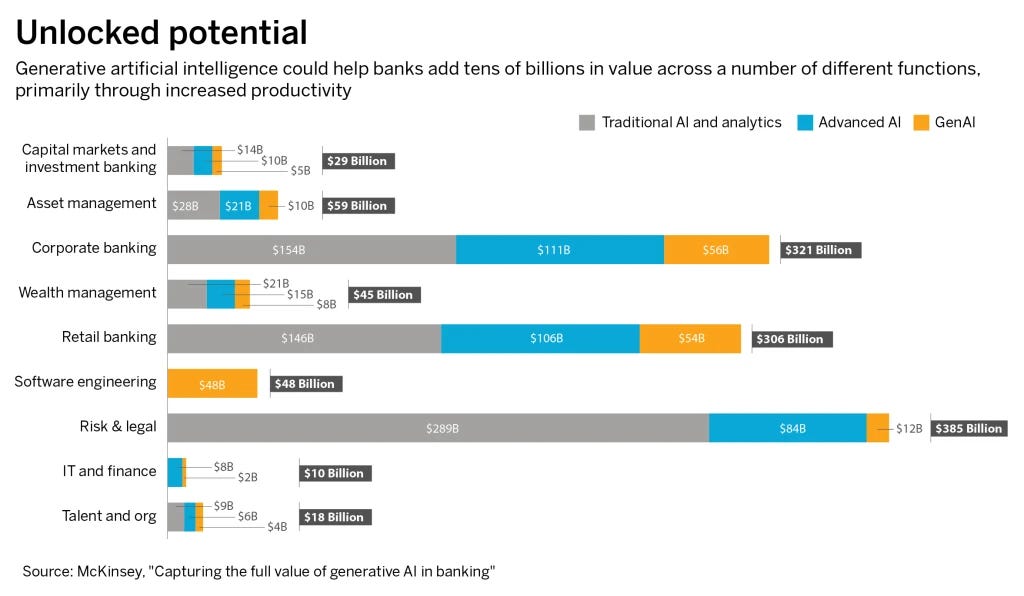

McKinsey's research indicates that generative AI can improve productivity by 30-90% in certain areas of corporate and investment banking. This is achieved by automating tasks like summarizing compliance reports or generating first drafts of pitch books, freeing up human bankers for more strategic activities.

At Multimodal too, our main focus in the banking vertical is to augment bankers with intelligent AI systems that take the repetitive work off their rosters. The reason?

Until recently, no technology has been sophisticated enough to meaningfully reduce the grunt work burden for experts like investment bankers. Generative AI is a tool that has human-like intelligence, is driven by context, and learns and improves continuously, which makes it perfect for such industries.

Adaptability

AI models are not static; they learn and evolve as they are exposed to new data, kind of like a human brain, except faster and more accurately. This adaptability is crucial in investment banking, where market conditions and regulations are constantly shifting.

Machine learning algorithms can continuously refine their models based on new information, ensuring that their insights and recommendations remain relevant and accurate.

A notable example is JPMorgan Chase's Contract Intelligence (COiN) platform, which uses AI to interpret loan agreements. This AI system has reportedly saved the bank 360,000 hours of manual work, demonstrating the power of AI to learn and adapt to complex financial documents.

By harnessing the power of data, pattern recognition, speed, and adaptability, AI is becoming an indispensable tool for investment banks. As this technology continues to evolve, we can expect even more innovative applications that will further transform the industry.

How AI is transforming investment banking: use cases

The impact of AI in investment banking is no longer theoretical—it's a tangible reality, reshaping the industry's landscape across multiple fronts. Let's delve into some of the most impactful use cases where AI is proving its mettle:

Due diligence

The due diligence process, often laborious and time-consuming, has been significantly streamlined by AI. Traditionally involving the manual review of countless documents, financial statements, and news articles, this critical step in evaluating investment opportunities is now being accelerated by AI-powered tools.

One such tool is Kira Systems, which leverages natural language processing (NLP) to swiftly analyze vast amounts of textual data, extracting key information, flagging inconsistencies, and even assessing potential risks. This not only saves hundreds of hours for legal and financial teams but also reduces the potential for human error.

Tools like these will never replace existing bankers, but they will make bankers’ jobs a hundred times easier and faster. This is why I always emphasize augmentation through AI.

Trading & algorithmic execution

With the rise of algorithmic execution, trading has become more sophisticated than ever before. These AI-powered algorithms analyze market data in real-time, making split-second decisions to execute trades based on pre-defined criteria. This removes the element of human emotion from trading and enables faster, more efficient execution.

Even during my time as a trader at Bridgewater, we had access to fancy tools and software to help us out. But as I mentioned before, none of them were able to deliver on the promise of making our jobs significantly easier. There was still too much to be done by human analysts, interns, and junior staff.

High-Frequency Trading (HFT), a subset of algorithmic trading, also shows AI's speed and precision. A good example here is Renaissance Technologies, a hedge fund renowned for its AI-driven strategies. It has reportedly achieved annualized returns of over 66% since 1988 using quantitative models. While not all firms achieve such extraordinary results, AI is undeniably transforming the trading landscape.

Risk management

Managing risk is a paramount concern for investment banks, and AI is proving to be a game-changer in this domain. Traditional risk models often rely on historical data and assumptions that may not hold up in rapidly changing markets. AI, however, can simulate thousands of scenarios and stress test portfolios and identify vulnerabilities with greater accuracy and speed.

BlackRock, the world's largest asset manager, employs its Aladdin platform, powered by AI, for risk analytics and portfolio management. This tool is used by numerous financial institutions globally, which shows how crucial AI can be in risk management.

Other hedge funds and asset managers have swiftly adopted AI for risk management. It’s important to note that these adoptions are fairly recent and have a bright future in the IB space. Smaller banks and boutique firms too will move to adopt more of these technologies - and for good reason.

According to S&P Global Market Intelligence, AI is becoming an "incremental game-changer" in risk management, enabling more accurate assessments and proactive mitigation strategies.

AI models can analyze vast amounts of data to assess creditworthiness, simulate market scenarios, and identify potential operational risks. Goldman Sachs' SecDb platform, mentioned in Business Insider, exemplifies how AI can aggregate data from various sources to provide a comprehensive view of risk exposure, enabling traders to make more informed decisions.

Sentiment analysis

The ability to gauge market sentiment is invaluable for investment decisions. AI-powered sentiment analysis tools analyze news articles, social media posts, and other sources of public opinion to determine how investors feel about specific assets or companies. This provides valuable alpha and insights into market trends and potential price movements.

Every finance professional today uses the Bloomberg Terminal. It offers sentiment analysis tools that aggregate data from various sources, enabling traders and analysts to make more informed decisions.

I also had the chance to interview Aakarsh Ramchandani on Pioneers. His company Ravenpack specifically uses advanced models for sentiment analysis and indexing as well. Similarly, there are other key players in this space making the financial industry much more aware and driving universal growth.

Portfolio management

AI-driven portfolio optimization: Portfolio optimization shouldn’t be a manual process. AI-powered tools now analyze massive amounts of data to identify optimal asset allocations based on an investor's risk tolerance and financial goals. This leads to more efficient portfolios and potentially higher returns.

Robo-advisors (for high-net-worth clients): While often associated with retail investors, robo-advisors are also gaining traction among high-net-worth individuals seeking automated, cost-effective portfolio management solutions. These AI-driven platforms leverage sophisticated algorithms to create and manage diversified portfolios tailored to individual needs.

Personalized investment strategies: AI's ability to analyze individual investor data and market trends enables the creation of highly personalized investment strategies. This approach takes into account factors like risk tolerance, financial goals, and time horizon to craft bespoke portfolios that align with each investor's unique needs.

BlackRock's Aladdin platform, mentioned earlier, also serves as a prime example of AI-driven portfolio management. Its AI capabilities not only aid in risk assessment but also facilitate portfolio construction and optimization.

Deal origination

AI-powered tools are transforming the way investment bankers identify and evaluate potential deals. By analyzing a wide range of data sources, including company financials, market trends, and news articles, AI can uncover hidden opportunities that may not be apparent through traditional research methods.

This enables bankers to proactively approach potential clients with relevant and timely advice, fostering stronger relationships and increasing the likelihood of successful transactions.

Fraud detection and compliance

AI is playing a pivotal role in maintaining the integrity of financial markets by detecting and preventing fraud. Anomaly detection algorithms can identify unusual trading patterns or transactions that indicate market manipulation, insider trading, or other illicit activities.

The Nasdaq Stock Market utilizes a sophisticated surveillance system called SMARTS, which employs AI to monitor for potential market abuse. This system analyzes billions of trades and orders daily, flagging suspicious activity for further investigation.

In addition to fraud detection, AI is also streamlining regulatory compliance. AI-powered tools can automate the monitoring of transactions and ensure adherence to complex regulatory requirements, reducing the risk of costly fines and reputational damage for investment banks.

A startup I was recently reading up on in the compliance space is Norm AI. They have configured large language models to ensure regulatory compliance in financial services and other industries.

By leveraging AI's analytical prowess and adaptability, investment banks are not only improving their operational efficiency but also gaining a competitive edge in the market. The use cases highlighted here are just the tip of the iceberg, and as AI continues to evolve, we can expect even more groundbreaking applications to emerge in the future.

Data integration and advanced analytics

Platforms like Palantir Foundry offer a robust solution for data integration and advanced analytics. By centralizing data from various sources, including traditional financial data, alternative datasets (such as satellite imagery or social media feeds), and internal documents, Palantir Foundry creates a unified view that empowers investment professionals to make more informed decisions.

The platform's ability to process unstructured data, such as news articles, social media sentiment, and satellite imagery, opens up a world of alternative data sources that can provide a competitive edge.

CAZ Investments, a Houston-based investment manager, partnered with Palantir in 2023 to leverage their AI platform for accelerating partner onboarding and augmenting investment managers' work with generative AI. This strategic move allowed CAZ Investments to streamline their operations, gain deeper insights into their data, and enhance their investment decision-making processes.

The future of AI in investment banking: augmenting human expertise

AI in investment banking isn't about a robot takeover—it's about a profound evolution of roles and responsibilities. Rather than replacing humans, AI is poised to augment their capabilities, creating a new paradigm for the industry where technology and human expertise work in synergy.

Redefining roles: the rise of strategic advisors

As AI takes on the heavy lifting of data processing and analysis, the role of investment bankers is evolving. Mundane tasks that once consumed countless hours are now automated, freeing up bankers to focus on higher-value activities that require uniquely human skills.

AI is simplifying investment banking by automating tedious tasks like processing legal documents and creating pitch books, allowing bankers to dedicate their time to more analytical and strategic pursuits.

I see future investment bankers becoming strategic advisors, leveraging their experience, intuition, and relationship-building skills to guide clients through complex financial landscapes.

The successful investment banker of the future will be the one who can best harness the power of AI to augment their skills. The use of AI in IB reemphasizes the growing importance of strategic thinking, negotiation, and client relationship management.

The "centaur" model: A powerful partnership

The optimal approach to AI integration in investment banking is the "centaur" model, where humans and AI collaborate, each playing to their strengths. This concept is well-illustrated by McKinsey's research, which found that "corporate and investment banks are tackling generative AI" by combining human expertise with AI's computational power.

Humans excel at tasks requiring creativity, empathy, and judgment, while AI excels at processing vast amounts of data and identifying patterns. This collaborative model is particularly relevant in investment banking, where strategic decisions often hinge on both data-driven insights and a deep understanding of client needs and market nuances.

Ethical considerations: building trust and transparency

Yes, AI has tremendous potential to change what investment banking looks like. But I can already see it creating ethical issues and fear in the industry as well. It is very hard to build and configure smart, compliant, and ethical AI systems, and I say this as someone who does it every day.

Fairness in algorithms, avoiding bias in AI-driven decisions, and ensuring transparency are crucial for maintaining trust and integrity in the industry.

The right way to look at AI in finance is to consider it a tool for augmentation rather than replacement. Trust me, we’re far away from having AI investment bankers capable of managing everything from client relationships to decks and presentations. But we can now have AI assistants to help with the stuff bankers hate doing.

I also host an AI podcast and content series called “Pioneers.” This series takes you on an enthralling journey into the minds of AI visionaries, founders, and CEOs who are at the forefront of innovation through AI in their organizations.

To learn more, please visit Pioneers on Beehiiv.

So what lies ahead for investment banking professionals?

Here are some of the most promising trends and innovations that are set to shape the industry:

AI and quantum computing

I have seen huge strides in quantum computing happening over the past year. With everything that’s evolving with AI too, a combination of the two could change investment banking.

Quantum computers, with their ability to perform complex calculations at speeds unimaginable for classical computers, could supercharge AI algorithms. This could lead to breakthroughs in areas like risk modeling, portfolio optimization, and fraud detection, enabling investment banks to make even more accurate and timely decisions.

While the full realization of this potential is still some years away, investment banks are already investing in research and development to prepare for this quantum leap.

NLP for deal sourcing and beyond

One area of significant development is the use of Natural Language Processing (NLP) for deal sourcing. NLP algorithms can analyze vast amounts of unstructured data, such as news articles, social media posts, and company filings, to identify potential investment opportunities or emerging trends.

Making AI work for investment banking

While trends sound appealing, here’s what you should know if you want to make the best of generative AI and related technologies as an investment banker:

Explainability is key. I can’t stress this enough. Look up the difference between black-box and explainable systems, and take your time to figure out which technologies would help you while remaining compliant.

The purpose of AI is to augment you. So don’t bite off way more than you can chew. Start small with AI - automating something as small as financial statement analysis or pitch deck creation will end up saving you hours, and you can always scale.

Vet each AI vendor you’re planning to work with to change the brick-and-mortar ways of your investment firm. You don’t want to be stuck with a system that makes you work more than you already do.

Next week, I’ll be exploring another ripe vertical in finance that could use AI to augment people and boost productivity.

Until then,

Ankur.