How to calculate AI ROI for your business

Calculating AI ROI for your business? This guide covers key steps, metrics, and real-world examples.

Key Takeaways

AI requires realistic expectations – focus on well-defined use cases aligned with your business goals.

ROI includes both financial and non-financial benefits – track short and long-term metrics to see the complete picture.

AI ROI evolves over time – establish a process for regular evaluation and adjustment of your projections.

Data quality is paramount – invest in collecting, cleaning, and preparing data to ensure your AI models perform optimally.

Ethical AI is key for sustainability – address potential biases and uphold privacy standards to protect your brand and long-term success.

Last year, I started Multimodal, a Generative AI company that helps organizations automate complex, knowledge-based workflows using AI Agents. Check it out here.

If you don’t know yet, my company Multimodal builds Generative AI solutions for businesses. We do a lot of sales calls because our solutions are complex and the buying decision can, understandably, be difficult to make.

What’s stopping most of our prospects from making it is that they simply don’t know how to estimate the ROI – “Will this pay off?” is probably the #1 question we get.

That’s why we usually estimate the ROI for them. But, in case you want to do it yourself, I’ll break down how we do it.

The simple formula

We start by using a simple, general formula for ROI. There are caveats, and we’ll dive into those, but let me show you the formula first:

ROI = Net gain from Investment/Investment Cost X 100

But, before you put it into action, we should first answer one important question…

What should you realistically expect out of AI?

Best-in-class companies reap a 13% ROI on AI projects - more than twice the average ROI of 5.9% - IBM

Let me backtrack a bit. The ROI formula above is neat, and makes for a good slide in your pitch deck... but the truth is, figuring out AI's actual value is about way more than some quick math. Sure, there's the obvious – cost savings, maybe a sales bump. But let's be honest, the real question every CFO should be asking is, "What does AI really do for this business?"

There's a disconnect between the sky-high expectations for AI and our current tools for measuring its actual business value.

The problem is that most companies are still figuring out how to actually measure AI’s impact. It's tempting to get caught up in the buzz, but if you want to see real results, you need a strategy.

The key is aligning AI with your specific business goals. It's not about jumping on every new model or chatbot – it's about finding those areas where AI can truly add value.

Consider these when calculating AI ROI

Traditional ROI is all about hard numbers – did we make more money than we spent? That approach can work for buying a new piece of equipment or hiring, but things get trickier with AI. The benefits AI can bring to a business aren't always easily shoved into a spreadsheet.

Why intangibles matter

It's tempting to dismiss outcomes like "improved customer experience" as fluffy, but don't make that mistake.

Some of the best payoffs from AI are in the stuff you feel more than you calculate. So how do you prove those are real?

Go to the source.

Employees: Are they ditching those mundane tasks and actually enjoying work more? Morale boost = serious long-term win, even if it's hard to quantify. Are they, and therefore your business, making decisions faster and saving precious time?

Customers: Do they feel like you're actually listening and solving their problems faster? Happy customers = loyal customers = $$$.

The Buzz Factor: Awards, press, and top talent knocking at your door might not have a dollar sign attached today, but those lead to future domination.

The Bottom Line Connection: Bean counters might roll their eyes at "happier employees". But less turnover saves real money on hiring and training. Or that rep for innovation? It lets you charge more, or land deals you'd never have snagged before.

“This might not be the traditional ROI,” - Todd Lohr, KPMG

How do you measure these results? That's tricky. You'll need a microscopic view of how things were "before", comparing every little detail to what happens after you roll out your AI plan.

Time horizons: The long and short of it

AI isn't a magic profit machine. Some AI projects may take longer to show positive financial results than traditional investments. That's why you should look at both short-term and long-term goals when evaluating AI's value:

Short-term goals: Focus on the things that make your life easier right away. Did your employees stop wasting hours on routine, mundane tasks? Are customers giving better feedback? Is your business handling simple tasks faster? Small victories matter, and they're the first sign your AI investment's paying off.

Long-term goals: Track how those happier customers start spending more, or how faster decisions help you corner the market. This is where you see AI isn't just about saving a few bucks, but rather about about transforming your whole business. Look for patterns that can be linked back to AI implementation.

Forget trying to cram this into a quarterly report. Think of AI ROI as a marathon, not a sprint. Get obsessed with tracking those metrics, and be ready to pivot when the data tells you to.

Key components of AI ROI calculation

The first step is to get a clear picture of both the costs and the potential benefits associated with your AI project. Be realistic and comprehensive in this accounting.

Costs: The full picture

We’ll get brutally honest about the costs. This goes way deeper than just buying some fancy software and calling it a day.

The obvious stuff:

Infrastructure: Servers? Cloud costs? That specialized hardware? It all adds up fast.

Software: AI subscriptions ain't cheap, and you'll probably need more than one tool.

The Human Factor: Data scientists don't work for peanuts, and someone has to manage this whole project.

Ongoing Maintenance: Upgrades, security... your AI is hungry, always needing more.

Data: The lifeblood of AI - sourcing, cleaning, and labeling good quality data is expensive.

Outside Help: Consultants, pre-trained models, or even outsourcing automation can be costly. (But they might be cheaper than building an AI model from scratch).

Sneaky costs (that'll bite you later):

Training Time: Employees learning the new system = hours NOT spent on their regular jobs.

Oops, We Broke It: Rollouts can be bumpy. Expect a few hiccups and productivity dips along the way.

Getting People Onboard: New tech can freak people out. Hand-holding and training take real effort.

The 'What If' Cost: Every dollar spent on AI is a dollar NOT spent somewhere else. Missed opportunities matter.

Where does the value lie for AI?

Productivity gains

Time Saved On Repetitive Tasks: AI can automate everything from customer service inquiries to report generation. Research backs this up: a McKinsey study found that over 60% of jobs have more than 30% automatable tasks, and automation of these would save enormous time.

Faster Task Completion: AI can sift through enormous amounts of data or complex calculations much faster than humans.

Cost reduction

Smaller Payroll, Bigger Profits: AI can automate a lot of repetitive work. This saves a ton of cash long-term.

Efficiency Overhaul: AI spots waste and streamlines everything from your supply chain to how you handle grumpy customers. Every dollar saved is a dollar earned.

The revenue increase: here's where it gets JUICY

Marketing That Knows Your Customers: Reaching the right customers at the right time = more sales. AI can spot patterns humans would miss, telling you what to sell, who to target, and how to stay ahead of the curve.

The Price is Right: Turns out that charging the perfect price is a science. AI can find that sweet spot, squeezing more profit out of every sale.

Happy Customers = Loyal Customers: AI keeps customers happy with personalized service and lightning-fast responses. It can also predict what they need before they even ask. Frustration melts away, and loyalty skyrockets.

Recommendations Done Right: No more generic suggestions. AI knows exactly what each customer will love.

Robots on the Clock: AI chatbots are your 24/7 support team.

Feeling Heard: AI can analyze customer emotions better than some humans. Means faster solutions and a rep for truly caring.

Methods for measuring AI ROI

We've got our costs and benefits mapped out, but how do we prove that AI is the reason for any positive change we see? Here are some methods to isolate AI's impact and get a clearer picture of its true ROI.

Baseline comparisons: the "before" picture

Before you deploy your AI solution, it's vital to establish a baseline for the key metrics you'll be tracking. How long does it currently take to complete a task? How much does a particular process cost? What's your current customer satisfaction score? Without this "before" snapshot, it's impossible to say how much improvement was truly driven by AI.

For example, when we started working with Talent Inc., the first thing we asked them was how much time they were spending analyzing each resume. On average, manually completing just one resume took them 3.5 hours—or 43.75% of the entire 8-hour workday. Most notably, their resume-writing service was mostly manual and slow. This changed massively once we deployed our AI agent, but we’ll get into that in a bit; I just wanted to show you an example of a baseline metric.

A/B testing or pilot programs

A/B testing is an excellent way to directly compare results with and without your AI solution. Run the AI version alongside your current process for a set period. Randomly assign subjects (customers, tasks, etc.) to each version to minimize bias.

The difference in results helps quantify AI's impact.

If A/B testing isn't feasible, roll out your AI solution in a limited scope first. This could be a specific department, region, or product line. Track metrics for the pilot group compared to your overall business to see if AI is making a difference.

Attribution modeling: it's not always black and white

Good business results can rarely be tied back to a single factor. For example, a successful marketing campaign might involve a new AI-powered targeting tool along with updated ad copy and a seasonal promotion. How do you tease out how much credit the AI deserves?

Be honest that directly attributing a specific dollar amount of increased sales solely to AI is often tricky.

This estimation model assigns partial value across different touchpoints in a customer's journey. An AI tool might get 30% credit for a customer conversion, while updated ad copy gets 20%, etc. While not perfect, it's a more nuanced approach than tying it all back to AI.

Scenario analysis: projecting the future

Scenario analysis lets you play with "what-ifs" to estimate the potential impact of AI under different circumstances:

Model scenarios with varying levels of AI adoption and success. This gives you a realistic range of potential ROI rather than a single, potentially over-optimistic number.

If your pilot program shows promise, use scenario analysis to project cost savings or revenue increases if you implement the AI solution company-wide.

Is there a reliable AI ROI calculator?

Unfortunately, no. Even if there was, it’s highly unlikely it would fit your particular business or industry.

This framework provides a structured method to help you evaluate whether an AI project makes sense for your business.

Step 1: Define goals and KPIs

Before diving into the numbers, ask yourself: What strategic goals does this AI project support? Are you aiming for faster innovation, improved customer experience, and reduced operational costs?

Choose relevant KPIs: Select KPIs that directly track progress towards your stated goal. Examples include:

Sales conversion rates

Customer churn reduction

Time-to-decision

The number of errors reduced

Customer satisfaction scores (like NPS)

For example, with the client I previously mentioned (Talent), we tracked conversions, time savings, and quality of resumes delivered pre vs post-AI implementation. Our agent reduced the time to complete a resume from 3 hours to 45 minutes, and conversion rates increased significantly. Same for quality - it went up because there were fewer errors and issues.

Step 2: Establish a baseline

Here's the game plan:

Data Hoarder Mode: Dig up every number you can find on how things are running now. Sales cycles, customer complaints, whatever matters to your business... this is your baseline.

How Do You Stack Up?: See how your numbers compare to others. Feeling like you’re falling behind in some areas? That’s where AI could give you a serious boost.

Digging for Hidden Gold: Even messy data can hide valuable insights. Are there weird spikes in costs at certain times? Or a type of customer problem that keeps popping up?

Remember, it doesn't have to be perfect. The goal is to have something to compare to once your AI is up and running.

Step 3: Estimate costs

Map out the costs I guided you through. Compare against industry benchmarks, especially against competitors who aren’t using AI the way you plan to.

Step 4: Quantify benefits

Again, measure benefits as mentioned above.

Step 5: Calculate!

At this stage, you could use the formula I presented at the beginning.

NPV/IRR Approach: Think of these as your crystal ball for figuring out if an AI project will actually deliver on those long-term promises. Don't worry if these terms sound alien, your CFO can break it down. It’s a good idea to loop in your finance team early on in your AI plans so they can change their existing models

Sensitivity analysis: Run the NPV calculation with different discount rates or slightly altered cost/benefit projections to see how much the result changes. This helps gauge the riskiness of the project.

Intangibles: Remember those "intangibles" we talked about? Well, if you can slap a number on them, factor that into your NPV for a more accurate picture.

Time horizon: NPV changes big time depending on how far you look ahead. This forces you to think beyond next quarter's earnings report, and get real about where AI fits into your company's future.

Be practical and realistic

Not every AI project will deliver huge returns in the first year. Be transparent with stakeholders about the following:

Short-term goals vs. long-term vision: Emphasize tracking progress on both. Initial ROI might focus on operational efficiency gains, while later stages may show increased revenue from AI-powered product innovation.

The learning curve: AI models often improve over time as they are exposed to more data. Factor this potential improvement into your ROI projections.

Remember to revisit your assumptions and calculations as the project progresses and learn from the data you collect. My team at Multimodal does this regularly for all our clients, too. It helps us identify and tackle potential issues head-on.

What challenges will you see down the road?

Calculating AI ROI isn't a one-and-done process. It can change based on several factors and external circumstances.

Challenge 1: Data is key

"Garbage in, garbage out" is an old computer science adage, but it rings especially true with AI. AI models are only as good as the data they're trained on.

If your data needs to include key fields, has errors, or isn't representative of real-world conditions, your AI models will produce flawed results. This directly messes with ROI calculations.

Even if you have loads of data, it won't do you much good if you can't access and use it effectively for AI:

Data silos: Is data scattered across departments, systems, and formats? Data cleaning and consolidation can be time-consuming and expensive.

Data governance and privacy: Compliance with regulations (such as GDPR or HIPAA) is super important when collecting and using data. For example, we work across many highly regulated industries like finance, healthcare, and insurance. Every project needs a legal check-up, slowing things down and making AI a minefield for costly mistakes. That’s why I always emphasize that the more generic your AI solution is, the less suitable it is for a regulated industry.

Challenge 2: Tech moves faster than you do

Remember when the iPhone was the hot new thing? AI's like that, but on steroids. What's cutting-edge today is old news tomorrow. This has several implications for ROI:

Depreciation of AI assets: Just like a car rolling off the lot, your AI model starts depreciating the second you launch it. It needs to be retrained or replaced as technology improves or your business conditions change.

Need for continuous evaluation: ROI isn't something you calculate once and forget. Put plans in place to regularly review the performance of your AI models and update ROI projections accordingly.

Investment mindset: View AI less as a one-time project and more as an ongoing R&D investment with evolving potential payoffs.

Challenge 4: Ethical considerations

AI raises ethical questions that can, directly and indirectly, impact how its ROI is perceived. In regulated industries, this again becomes more heightened. Some things we’ve seen our customers be concerned about include:

Did an AI-powered recommendation system inadvertently lead to customers being offered predatory loan products? Even if it technically boosted short-term revenue, that kind of fallout damages trust and future business.

If an AI tool is found to be biased, it might lead to legal costs, fines, or a damaged reputation which translates into lost customers.

If consumers feel uneasy about companies using AI due to privacy or fairness concerns, it could create a general headwind even if your implementation is ethical.

Removing roadblocks

We address these concerns proactively for all our clients at Multimodal. As a thumb rule, communication is key. But it’s even more important to have buffers in place for when something goes wrong.

Emphasize data quality initiatives: Clean data should be a company-wide priority, not just an AI team concern.

Build a flexible ROI framework: Account for the need to update models, and costs of keeping up with technological advances, and factor in potential ethical risks.

Communicate transparently: Be open with customers, employees, and regulatory bodies about how you are using AI. This builds trust that can’t be bought.

AI x real dollar value

In the next 12 months, 43% of U.S. companies with at least $1 billion in annual revenue expect to invest at least $100 million in generative AI. Yes, GenAI projects, machine learning initiatives, and even simpler automation projects come with hefty price tags. But there’s a reason why both legacy and newer companies are taking this leap of faith with AI.

Some companies choose to build their AI tools with proprietary models offered by OpenAI or Google, while others use open-source models like LLaMA by Meta. APIs are often a point of entry and there’s some fine-tuning involved here too. In any case, business operations become smoother, while allowing more flexibility and efficiency.

When we think of AI working excellently for companies, brands like Netflix, Caktus, Talent, and a few others stand out.

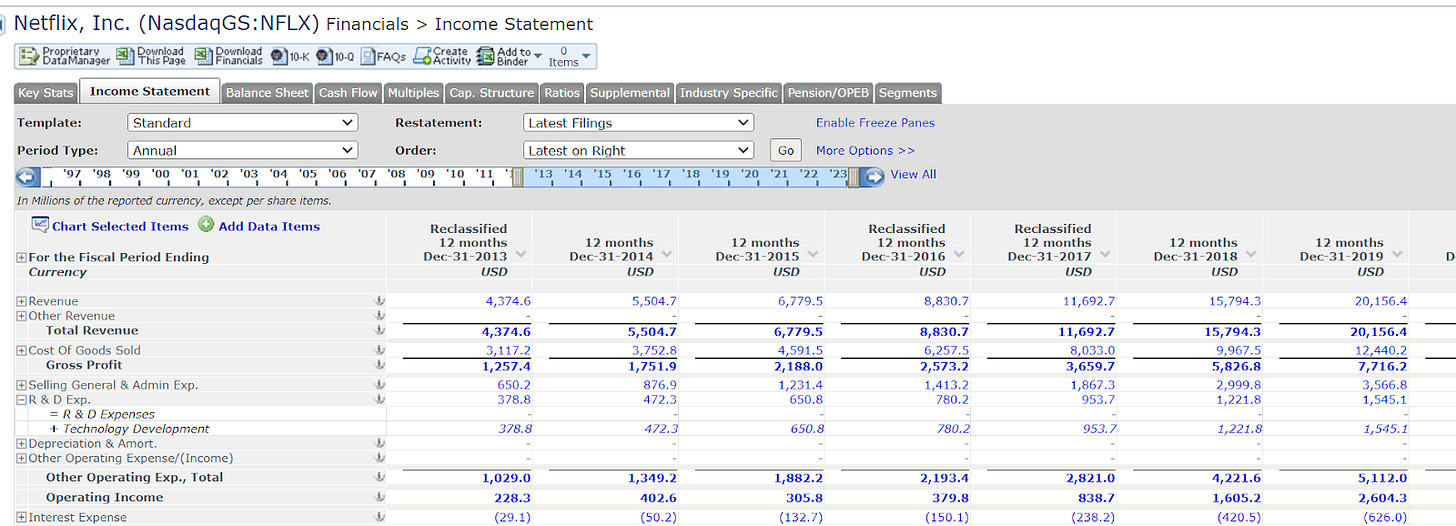

Besides making its recommendation engine so much better, Netflix’s AI saves it $1 billion every year. Since 2016, Netflix has been increasing its technology and development budget:

Close to 10% of its revenue goes towards this. Besides, it also has increasingly invested in its AWS partnership. With revenues increasing significantly each subsequent year, NFLX is seeing a positive AI ROI.

We worked with Caktus on their academic AI model, which helped it acquire tens of thousands of subscribers and grow sustainably.

With DirectMortgage, we saw a 20x faster time to approval on their loan applications and costs came down by 80% with our AI solution. Just for context, the financial industry is heavily regulated. Many lenders use AI to automate the process slightly, but the errors and mistakes make it high stakes and always need heavy human involvement.

Measuring each of these impacts has needed careful scrutiny while holding intangibles just as important as some of the more concrete metrics. We also experienced that working directly with CFOs at each of these companies makes the calculation way easier. There’s the challenge of adjusting existing NPV calculation models to reflect AI-specific benefits and costs - but the results make AI investments far more compelling.

Learn from others’ mistakes

For every Netflix, Caktus, or Talent, there are hundreds of failure stories as well. In regulated industries especially, the problems are more prevalent. Several robo-advisors shut down or were acquired, including WiseBanyan.

MD Anderson Cancer Center in Texas invested heavily in IBM's Watson for Oncology but reportedly experienced delays and usability issues. While the technology's potential remains, this demonstrates the potential disconnect between initial promises and the complexities of deploying AI in real-world healthcare settings.

I also host an AI podcast and content series called “Pioneers.” This series takes you on an enthralling journey into the minds of AI visionaries, founders, and CEOs who are at the forefront of innovation through AI in their organizations.

To learn more, please visit Pioneers on Beehiiv.

So what’s the way forward really?

Big-tech companies have cash to burn with AI. You might not. And unless you’re realistic, you can end up losing. That is why these AI ROI calculations become so crucial.

Also, I can’t emphasize the importance of choosing the right AI partner for your industry and business enough. Don’t try to copy what Netflix or Intel did if you’re not at their scale or in the same industry. Your solutions will always look different and should be super unique to your niche. Work with AI players who cater to niche industries and aren’t all over the place.

You’d never choose someone with zero tech experience as your CTO. So don’t do the same with AI either.

Once you have a good AI partner, share your historical data with them, identify unusual patterns, and then emphasize the need for a positive ROI and your expectations.

We’ll explore other implications of Gen AI for your business in two weeks.

Stay tuned,

Ankur