BloombergGPT: Making Finance Smarter with Generative AI

BloombergGPT is a 50-B parameter LLM developed by Bloomberg. Its finance domain-specific training makes it unique, powerful, and useful. Read to know more.

Key Takeaways

BloombergGPT is a 50-billion parameter large language model developed by Bloomberg specifically to analyze financial text data.

The model is capable of generating natural language text, answering questions related to financial information, and providing insights into market trends and sentiment.

It can also summarize news articles and generate headlines and reports based on blurbs.

Lastly, BloombergGPT is capable of performing sentiment analysis, classification, and named entity recognition with finance-specific news or data.

BloombergGPT was evaluated on multiple financial NLP benchmarks as well as internal Bloomberg tasks. It also gives state-of-the-art performance on general tasks and is competitive with models like GPT NeoX.

Some key applications of BloombergGPT include equity news analysis, data cleaning on the backend, news, and headline generation, and converting natural language queries to BQL.

This post is sponsored by Multimodal, an NYC-based startup setting out to make organizations more productive, effective, and competitive using generative AI.

Multimodal builds custom large language models for enterprises, enabling them to process documents instantly, automate manual workflows, and develop breakthrough products and services.

Visit their website for more information about transformative business AI.

In our recent post about fine-tuning, we explored how training existing large language models on domain-specific data can help these models become more efficient at producing specific results. While this fine-tuning approach works for most industries and applications, things aren’t as simple when it comes to data-intensive and dynamic industries like finance.

The finance industry is replete with huge datasets that keep changing or updating on a daily basis. The dynamic, precise, and complex nature of this industry is the reason it has been comparatively slower to adapt to generative AI, particularly large language models. But with Bloomberg’s latest large language model BloombergGPT, finance looks to be catching up fast to GenAI.

In this article, we will explore the role of BloombergGPT in the finance industry and its potential impact on financial decision-making.

What is BloombergGPT?

BloombergGPT is a 50-billion parameter large language model developed by Bloomberg specifically to analyze financial text data. It is trained on a massive corpus of financial data owned by Bloomberg, along with news articles, research reports, and other financial information.

BloombergGPT isn’t a fine-tuned version of OpenAI’s GPT model. These models only share the basic transformer architecture and the training process.

The model is capable of generating natural language text, answering questions related to financial information, and providing insights into market trends and sentiment. It can also summarize news articles and generate headlines and articles based on blurbs.

BloombergGPT is designed to help financial professionals analyze market trends, identify potential risks and opportunities, and make better investment decisions.

Background and Development of BloombergGPT

Large language models are able to analyze vast amounts of data within seconds and often provide a better basic analysis of the data than humans. While several financial data companies have been integrating AI into their operations for a long time in multiple ways, the true potential of LLMs has never been harnessed in this domain.

According to the official paper announcing BloombergGPT,

“The use of NLP in the realm of financial technology is broad and complex, with applications ranging from sentiment analysis and named entity recognition to question answering. Large Language Models (LLMs) have been shown to be effective on a variety of tasks; however, no LLM specialized for the financial domain has been reported in literature.”

BloombergGPT was developed by Bloomberg as a response to the need for a tool that could help financial professionals analyze large amounts of data quickly and accurately. The model was trained on a vast amount of financial data, including news articles, social media posts, and financial reports, to help it understand the nuances of the financial market.

Key Features and Capabilities of BloombergGPT

Here are some of the key features of BloombergGPT:

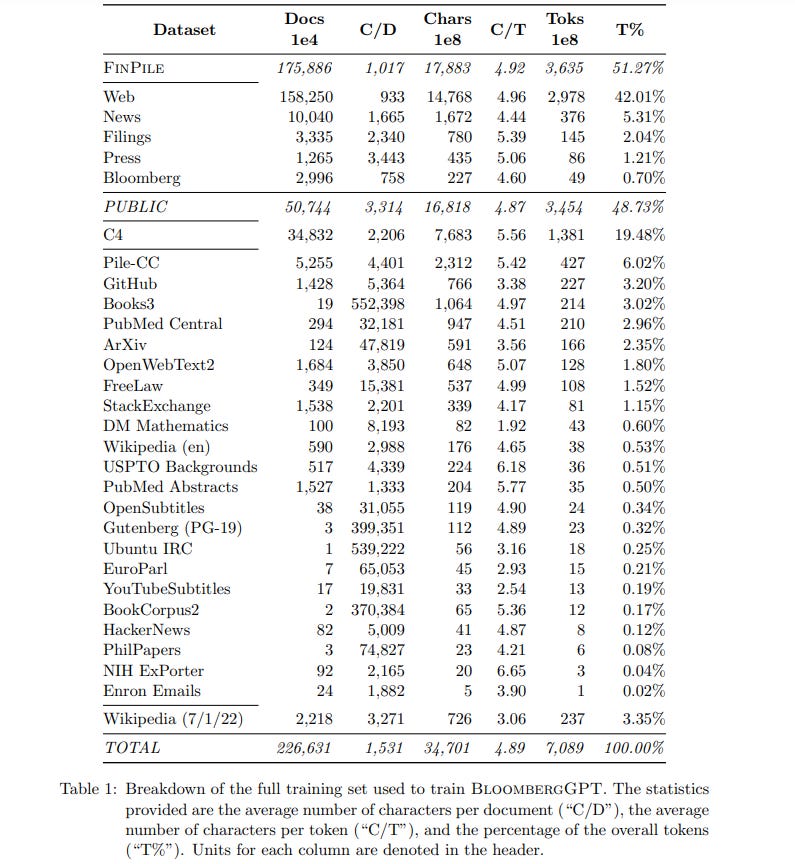

Size of the model and dataset: As mentioned earlier, BloombergGPT is a 50-billion-parameter large language model. It has been trained on a 363 billion token dataset made of financial data stored and generated by Bloomberg over the years.

This domain-specific dataset was augmented with a general-purpose 345 billion token one. The financial dataset called FinPile consists of years of English financial documents Bloomberg has retained, like news articles, stock price changes, market reactions, big events, etc.

Tasks: BloombergGPT is capable of performing sentiment analysis, classification, named entity recognition, and question answering with finance-specific news or data. Most LLMs are equipped to carry out these tasks, but financial terminology isn’t well-documented and classified in those training datasets. That is why they cannot perform financial tasks.

Domain-specific training: There are several domain-specific LLMs serving a multitude of industries. However, most of these large language models are trained only on domain-specific datasets without enough general-purpose data. BloombergGPT is a BLOOM-style model with both general-purpose as well as domain-specific training.

Evaluation on different benchmarks: BloombergGPT was evaluated on multiple financial NLP benchmarks as well as internal Bloomberg tasks. It also gives state-of-the-art performance on general tasks and is competitive with models like GPT NeoX. Check out the following table for more information regarding evaluation benchmarks.

Bloomberg Query Language conversion: Most financial professionals are familiar with BQL, the language that Bloomberg systems use to interact with financial data. BloombergGPT can convert natural language queries to BQL to make the process of accessing Bloomberg data through its terminals easier.

Architecture: BloombergGPT is a decoder-only causal language model. It contains 70 layers of transformer decoder blocks. It has a standard left-to-right language modeling objective.

Benefits and Highlights of BloombergGPT

One of the key benefits of BloombergGPT is its ability to process vast amounts of financial data quickly and accurately. This is particularly important in the fast-paced world of finance, where markets can change rapidly and investors need to be able to make decisions quickly. With BloombergGPT, financial professionals can analyze data from a wide range of sources and get insights in real time.

BloombergGPT’s ability to understand financial jargon and terminology allows the model to analyze financial text data more accurately than general-purpose language models like GPT.

Another advantage of BloombergGPT is its ability to understand natural language. This means that financial professionals can interact with the model using everyday language, rather than having to use complex programming languages or specialized financial software.

This makes it easier for non-technical professionals to use the model and get insights from it. Having said that, it is still a long way from when high-level investment bankers and other professionals can rely on LLMs to synthesize and analyze financial data on a daily basis.

BloombergGPT is also highly customizable. Financial professionals can train the model on specific data sets and tailor it to their specific needs. This means that they can get insights that are highly relevant to their particular area of expertise, rather than relying on generic analysis.

Applications of BloombergGPT

Financial research: For non-professionals who require the Bloomberg terminal for research, BloombergGPT can help make the process smoother and more efficient.

Equity news analysis: Most news outlets reporting financial news typically do sentiment analysis of equity news. One of the internal financial benchmarks that BloombergGPT was tested on was equity news analysis and it performed better than other similar models.

Data cleaning and processing on the backend: BloombergGPT can clean the Bloomberg terminal data on the backend.

Other ways in which financial LLMs like BloombergGPT can be used are credit risk analysis, predictive analysis, fraud detection, and chatbots for retail financial applications.

The finance industry generates an enormous amount of textual data every day, including news articles, research reports, company filings, and social media posts. This data is often unstructured and difficult to analyze using traditional methods. However, LLMs like BloombergGPT can process this data quickly and accurately, allowing financial analysts and investors to make better-informed decisions.

One key application of LLMs in finance is sentiment analysis. By analyzing the language used in financial news articles and social media posts, LLMs can provide insights into market sentiment and investor behavior. This information can be used to identify trends and predict market movements.

Another application of LLMs is in the area of natural language generation (NLG). NLG involves using AI to generate natural language text based on structured data. In finance, NLG can be used to automate the generation of research reports, earnings summaries, and other financial documents. This can save time and improve the accuracy of financial analysis.

Most applications of BloombergGPT revolve around enabling financial professionals to save time and money while staying updated about the news. It could save hours of a banker’s or accountant's time by helping them analyze financial news every day. Such applications would only get more sophisticated with time, opening up further possibilities for financial data analysis and decision-making by LLMs.

Understanding the Significance of LLMs in Financial Analysis and Decision-Making

The accuracy and speed of LLMs make them ideal for financial analysis and decision-making. LLMs can analyze large datasets with precision and provide insights that would be difficult or impossible to obtain through traditional methods.

Additionally, LLMs can process information in real time, allowing financial professionals to make informed decisions quickly. As such, LLMs have already made a significant impact on the finance industry, with their potential for further advancements yet to be fully realized.

Challenges of Implementing LLMs in the Financial Sector

There are challenges to implementing LLMs in the financial sector, such as addressing ethical considerations and potential biases. It is important to remain vigilant in addressing these challenges to ensure that LLMs are used in a responsible and ethical manner.

Hallucinations: LLMs like BloombergGPT are capable of hallucinating. In creative industries like marketing and content creation, these hallucinations do not do much harm. But finance is precise by nature, and hallucinations could result in big losses.

Nature of the industry: In finance, prudent management is prioritized over breakthrough innovation. The industry is lined with complex regulations and even slight mistakes can have major consequences for all stakeholders. As a result, many financial professionals might be reluctant to adopt such models.

Computational limitations: Traditional AI has been widespread in finance for a long time. In a report titled “State of AI in Finance”, NVIDIA confirmed,

“Across all sectors of financial services—capital markets, investment banking, retail banking, and fintech—over 75 percent of companies utilize at least one of the core accelerated computing use cases of high-performance computing (HPC), machine learning, and deep learning.”

However, LLMs have limited computational abilities and aren’t good at math. In an industry where mathematical calculations are crucial to decision-making, such limitations can be costly.

Comparison With Other LLMs Used In Finance

BloombergGPT is one of the most advanced financial LLMs available, but there are other models that are also used in finance. A common example is FinGPT, an open-source LLM capable of carrying out similar tasks as BloombergGPT.

BloombergGPT has been specifically trained on financial data, which gives it an advantage over other models that have not been trained in this way. There aren’t many financial LLMs that have the same data resources as Bloomberg did.

Conclusion

Large language models have already made a significant impact on the finance industry, but their potential for further advancements is not yet fully realized. The accuracy and speed of LLMs can be improved, enabling financial professionals to make better decisions. Additionally, LLMs could be used to predict market trends and identify potential risks and opportunities in real time.

BloombergGPT has emerged as a pivotal player in the financial domain, providing cutting-edge AI solutions that are transforming the industry.

As the industry continues to embrace AI, there will be opportunities for LLMs to be integrated with other technologies. This integration could lead to more powerful and effective tools for financial professionals. Having said so, it is also important to remain vigilant in addressing ethical considerations and potential biases.